ARTICLE AD BOX

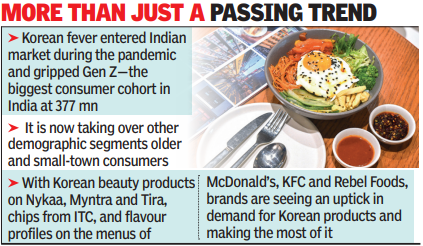

Indian Gen Zs are crazy about everything Korean - the trend is not new, but what makes it interesting is that it has sustained in the digital age of fast-changing fads. It started with BTS and 'Crash Landing on You' and then swept the food, fashion and beauty spaces.

The trend picked up during the pandemic - confined to their homes, more people explored global content. Now, it is slowly becoming broad-based; consumers from other cohorts are also catching up with 'Hallyu' - the Korean wave - and companies are tapping into this trend to get more shoppers. "Culturally, there are many similarities (between the two countries) which is why K-brands are welcomed by Indian people. Also, Gen Z and Gen Alpha consumers are open to accepting new concepts," said Paul Lee, managing director & country head at Korean beauty brand Amorepacific's India unit.

Brands try to catch the Gen Zs young. And there's good reason to do that - at 377 million, Gen Zs (born between 1997-2012) make up India's biggest consumer cohort. Many of them are also joining the workforce now, which means their ability to spend will grow. For Reliance's Tira, K-beauty has played a "catalytic" role in engaging the Gen Z audience, said a company spokesperson. "...they are not only early adopters but also trend diffusers for other age groups," the firm said.

Korean trends aren't just passing through, they are embedding themselves into everyday lives and shaping choices across industries, said Aparna Bhawal, CMO at KFC India & partner countries, which is building a Korean flavour profile. It has helped the brand drive trials among young consumers. "With K-dramas and music just a click away, Korean culture is now both accessible and relatable. This influence rubs off on food choices too, " Bhawal said.

Initially driven by Gen Z and younger audience, the Korean food interest is now cascading across broader demographic segments, said a spokesperson at Westlife FoodWorld, which runs McDonald's in the South and West. The same is true for Tira, from where working professionals and older demographics are now buying Korean beauty products.The Korean craze is gripping smaller towns as well, said Nykaa which will continue to expand the choice of K-Beauty brands on its platform.

"From hydration staples to derma-led brands, K-beauty has evolved from fandom-led discovery to a mainstream, performance-driven category," the company said. Rival Myntra claims to have recorded a 200% YoY surge in demand for K-beauty. For ITC Foods too, Korean flavour profile is equally gaining traction in smaller towns, said Hemant Malik, executive director at ITC. The brand's Bingo! Korean chips, in fact, is one of the top penetrated products in Indian households. What has also helped the K-wave is the inclusion of Korean cuisine in restaurants and launch of Korean eateries, said Nishant Kedia, CMO, India at Rebel Foods. "Burgers worked very well among the three.

Some of the items from the three ranges of products are now ongoing items in our menu," Kedia said.

.png)

.png)

.png)

2 hours ago

5

2 hours ago

5

English (US) ·

English (US) ·