ARTICLE AD BOX

NEW DELHI: PM Narendra Modi's announcement of a GST revamp is set to push states, especially those ruled by Opposition parties, to agree to the Centre's rate rationalisation plan, with the finance ministry's calculations suggesting that the exercise will result in a short-term impact on revenue, which will be more than made up in the coming months on the back of higher consumption.During ministerial meetings panel on rate rationalisation, led by Bihar deputy chief minister Samrat Chaudhary, states such as Kerala, West Bengal and Karnataka had opposed reducing the slabs or effecting major changes, fearing revenue loss, and had suggested that high-end shoes and clothing be taxed at higher rates.

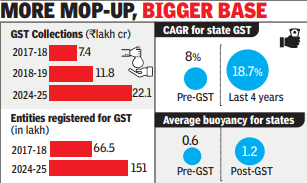

More mop-up, bigger base

The Centre has, however, gone for a mammoth overhaul, seeking to simplify the regime and make it more predictable.

"The changes will provide a massive boost to consumption and support growth in collections as well as economic activity. If we introduce the tax changes around Oct , then we will make up for the hit by end of the year. We expect the typical Laffer curve impact, which will see more people coming in, and higher consumption," said a finance ministry official.Economist Arthur Laffer's theory suggests that excessively high and low tax rates result in low revenues and tax cuts can potentially enhance collection.

While the overhaul road map has been circulated to the GoM, the Centre is hoping that based on the discussions in the panel, a meeting of the GST Council is held in Sept-Oct for the new rates to kick in ahead of Diwali. Separately, finance minister Nirmala Sitharaman is expected to hold talks with the states to push for the Centre's proposal.

.png)

.png)

.png)

10 hours ago

3

10 hours ago

3

English (US) ·

English (US) ·