ARTICLE AD BOX

A billboard at the Vadinar Refinery complex operated by Nayara Energy Ltd. near Vadinar, Gujarat, India. (Photo: Dhiraj Singh/Bloomberg)

Summary is AI Generated. Newsroom Reviewed

One month after being hit by European Union sanctions, India’s Nayara Energy Ltd. is relying on a growing pool of dark-fleet tankers to transport its products, and a narrowing menu of crude imports to keep its operations running.

The oil refiner’s struggle for survival has come to the attention of India’s government, which is concerned about disruptions to oil flows that could jeopardize national energy security, according to people familiar with the matter. New Delhi has approved at least one coastal tanker in recent days to help the company move cargoes domestically, they said.

The refiner, part-owned by Russian oil major Rosneft PJSC, is an important pillar of the Indian market. Its 400,000 barrels-a-day processing plant accounts for 8% of the country’s refining, and the company operates 7% of its fuel stations. It’s been forced to reduce run rates after being spurned by trade partners following the EU’s measures targeting Moscow’s oil revenues.

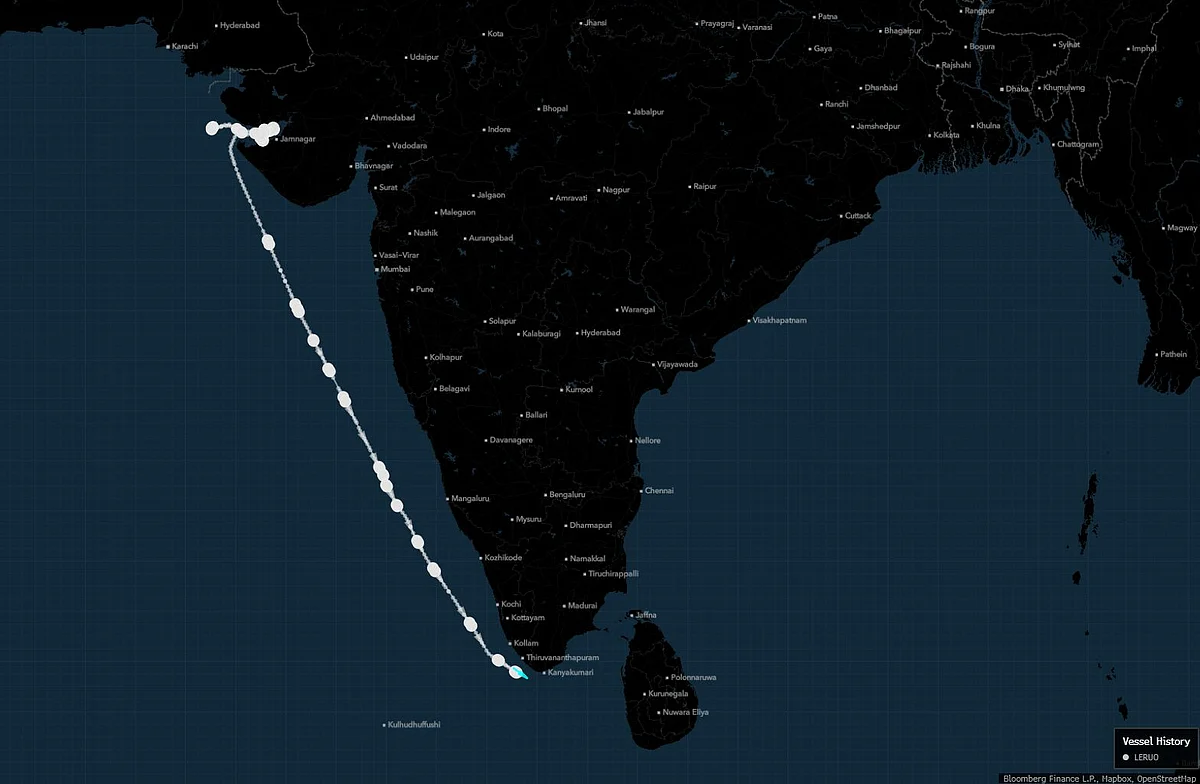

Some of the tankers already greenlit by the government to supply Nayara with oil, and transport its refined products, include sanctioned vessels. One such dark-fleet ship, the Leruo, has made at least three domestic runs for Nayara after getting the go-ahead from New Delhi, according to a shipowner, who declined to be named discussing sensitive information, and ship-tracking data.

Leruo has made at least three runs for Nayara since July 30

The medium-range tanker was blacklisted by the EU on July 18, part of a broad sanctions package targeting Russian oil exports that also penalized Nayara. Leruo’s owner is listed as Key Marvel Ltd. on S&P Global Inc.’s maritime database, although no contact details were included.

Long-range tanker Next, another EU-sanctioned vessel that’s also blacklisted by the UK, is due to arrive at Nayara’s Vadinar terminal on Wednesday to pick up a cargo of diesel, according to a port agent’s report and ship-tracking data. The database lists Istanbul-based Next Maritime & Trading Ltd. as its owner, again with no email or phone number.

Such vessels are filling the gap left by local shipowners that have stopped doing business with Nayara. They’ve been forced to cut ties to protect their dealings with European ports and insurers. Ships that are covered by Russian or Iranian insurance —and which have been approved by New Delhi — are eligible to service Nayara.

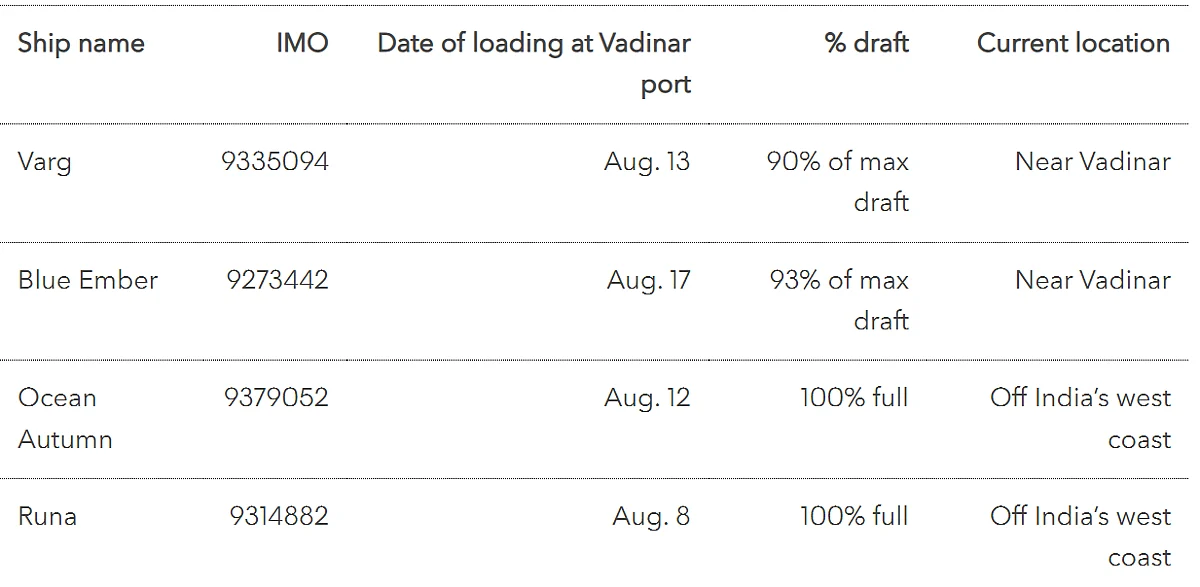

Nayara has more than 1.2 million barrels of refined products on four sanctioned vessels idling off Vadinar, according to shipping data.

The company didn’t immediately respond to a request for comment. In a statement last week, it said it remains committed to transporting its products via coastal, rail and road networks in order to efficiently serve its Indian customers.

Tempest Dream, a tanker that recently made a ship-to-ship transfer of gasoline produced by Nayara, has returned to Vadinar to receive more product, according to ship-tracking data. The vessel that took the cargo, Wu Tai, has yet to discharge the shipment, the data show.

Nayara has only taken Urals oil from Russia as feedstock since late July. The refiner is expected to receive two cargoes of Urals this week, totaling about 1.4 million barrels, on two Aframax tankers, the Mars 6 and Tiger 6, according to a shipowner, who declined to be named, port agent reports and ship-tracking data.

Another Greek-owned supertanker, Evgenia I, which was supposed to deliver Middle Eastern crude to Nayara last week, is still ballasting in the Persian Gulf.

Keeping up Russian crude supplies to Nayara isn’t a problem, Evgeny Griva, Moscow’s deputy trade representative in India, said at a briefing in New Delhi on Wednesday. More broadly, the country’s imports of Russian oil are expected to continue at current levels, despite the geopolitical situation, given the lack of alternatives, he said.

“There are special mechanisms to get around sanctions and tariffs,” Griva said.

Modi Hails China Ties As Bessent Swipes At India For Russian Oil Purchases

.png)

.png)

.png)

1 day ago

5

1 day ago

5

English (US) ·

English (US) ·