ARTICLE AD BOX

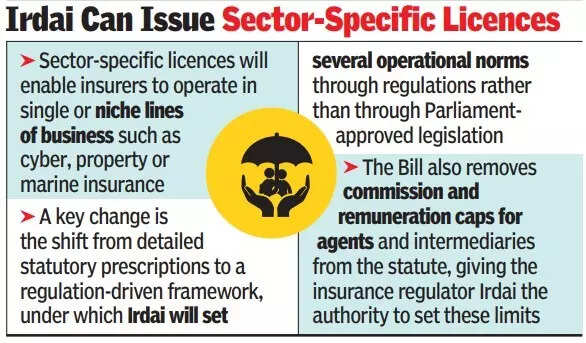

MUMBAI: The insurance sector is expected to see significant investments with the Sabka Bima Sabki Raksha (Amendment of Insurance Laws) Bill, 2025, to be introduced by the government in the winter session of Parliament.The Bill seeks to enable 100% FDI in insurance and allows Irdai, the regulator, to issue sector-specific licences, permitting new insurers to operate in single or niche lines of business such as cyber, property or marine insurance. The Bill does not specify whether composite licences permitting both life and non-life insurance under one entity will be allowed. The amendment states that govt can notify such other class of business that can be licenced in consultation with Irdai.The proposed law amends the Insurance Act, 1938, the LIC Act, 1956, and the IRDA Act, 1999. The amendments seek to widen capital access, modernise regulation, and expand insurance coverage by shifting oversight from statute to regulation.

.

The regulator’s financial powers are also proposed to be strengthened. According to the Bill, Irdai will be allowed to retain 25% of its annual surplus in a reserve fund to meet its expenses.

A policyholders’ education and protection fund will be created, funded through penalties imposed on insurers. The definition of insurance intermediary has been expanded to include entities such as insurance repositories.A key change is the shift from detailed statutory prescriptions to a regulation-driven framework, under which Irdai will set several operational norms through regulations rather than through Parliament-approved legislation.

Under the amendments, parameters such as minimum capital requirements, solvency margins, and investment norms will be moved out of the Act and placed under regulatory control. This allows Irdai to prescribe different capital requirements for different categories of insurers.

Fixed statutory investment mandates, including compulsory allocations to government securities and approved investments, will be replaced by investment conditions specified through regulations.The Bill also removes commission and remuneration caps for agents and intermediaries from the statute, giving Irdai the authority to set these limits. Licensing requirements for surveyors and loss assessors are proposed to be eased, with oversight shifting to a regulatory framework. The Bill allows LIC to establish zonal offices without prior approval from the Centre. Overseas LIC branches will be permitted to maintain funds.

8 hours ago

5

8 hours ago

5

English (US) ·

English (US) ·