ARTICLE AD BOX

MUMBAI: India Inc is likely to continue to build on the relatively better showing of the July-Sept quarter (Q2FY26) as it starts announcing quarterly numbers for the Oct-Dec quarter (Q3FY26).

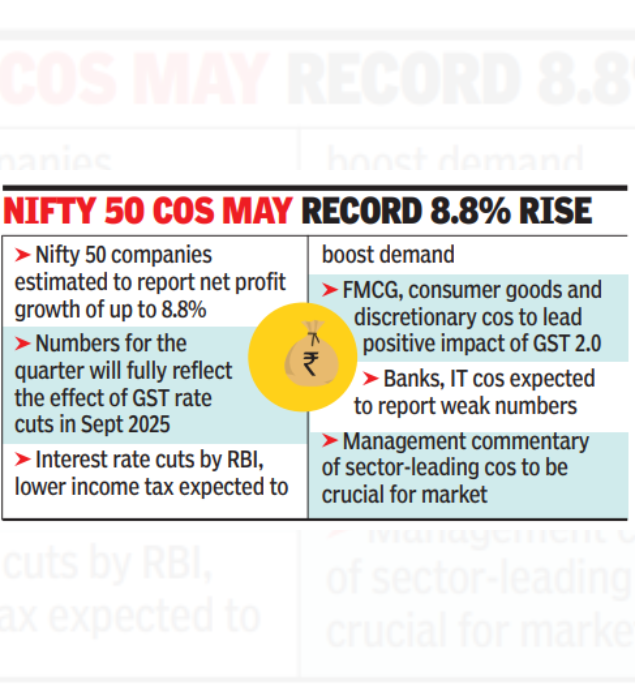

Nifty 50 companies are expected to report net profit growth of up to 8.8% for Q3FY26 while sensex stocks could report net profit growth of 6.1%, estimates by analysts at Kotak Securities, Motilal Oswal Financial Services (MOFSL), Axis Securities and Emkay Global Financial Services showed. FMCG, consumer durables and consumer discretionary companies are expected to report strong quarterly numbers, riding mainly on the back of GST rate cuts in Sept, analysts said.

On the other hand, banks and IT are expected to report muted net profit growth during the just-ended quarter. Some pharma companies are also expected to face pricing challenges and hence report lower growth numbers, they said.

Analysts also expect companies that are outside of the two leading indices to announce better results. For example, Kotak Institutional Equities expects the 30 sensex companies together to report a net profit growth of 6.1% while the companies within the broker's coverage universe of nearly 300 are expected to announce an 8.8% growth.

Similarly, for MOFSL's 345 companies, the net profit growth is estimated at 16%, an eight-quarter high, compared to 8% for the Nifty companies.

And a report by Emkay Global expects the BSE500 companies to register a 14% net profit growth in Q3FY26 against an 8.5% growth for the Nifty. "We see a pickup in earnings and turnaround in Q3FY26 breaking the last six-quarter consolidation, with the Emkay universe delivering top line growth of 10.7% YoY in Q3FY26 against 5.6% in Q2FY26.

A pick-up in festive season demand, coupled with GST rate-cut tailwinds, drove the strong discretionary earnings, leading to 14.5% PAT growth," a report by Emkay Global Financial Services noted. Going forward, analysts also expect the earnings momentum to pick up steam since downside risks seem to be limited. According to a report by Axis Securities, Q3FY26 results are likely to reinforce a phase of consolidation, with selective stock and sector-specific opportunities rather than a broad market up move.

Market breadth is therefore expected to remain narrow in the near term, favouring companies with strong balance sheets, visible earnings momentum, and pricing power.

"Overall, while downside risks appear increasingly contained, a clear directional shift in market growth is likely only once earnings momentum broadens and sustains, potentially setting the stage for a healthier expansion in the latter part of CY26."

2 hours ago

6

2 hours ago

6

English (US) ·

English (US) ·