ARTICLE AD BOX

MUMBAI: RBI's forex reserves rose $392 million in the week ended Jan 9, lifted by a $1.6 billion jump in gold value that offset a $1.1 billion fall in foreign currency assets. Total reserves climbed to $687.2 billion, reversing part of the previous week's $9.8 billion decline, RBI data released Friday showed.Foreign currency assets, the largest reserve block, slipped $1.1 billion to $550.8 billion, reflecting valuation effects from moves in the euro, pound and yen. Gold value surged $1.6 billion to $112.8 billion. SDRs eased $39 million to $18.7 billion, while the IMF reserve position fell $13 million to $4.8 billion.

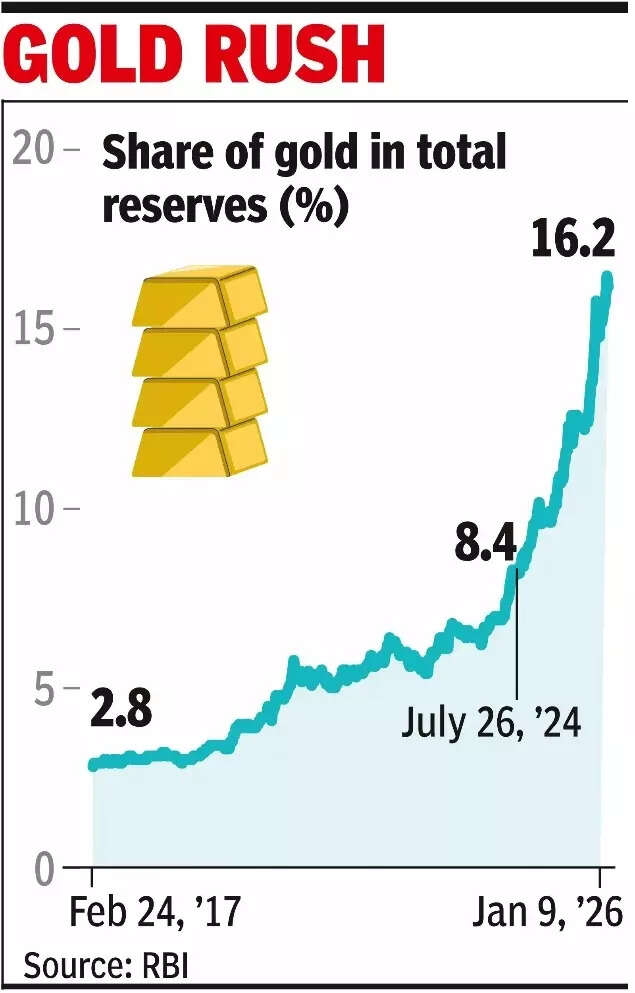

Beyond the weekly print, the reserve mix has shifted. Gold's share rebounded from a 2007 trough of around 2.8% to 16.2% by Jan 2026, the highest in over two decades.

Price gains helped, but tonnage drove the move: holdings rose from around 357 tonnes in the early 2000s to around 880 tonnes by late 2025, with buying accelerating through FY25.Last week's increase is seen largely as a result of higher international gold prices. Gold prices in global markets rose about 2.5% in the past week and about 5.5% over the past month.RBI's forex management strategy appears aimed at reducing dollar-heavy concentration, adding a counterparty-free hedge, and securing custody.

Even so, foreign currency assets still dominate; gold's slice has widened, not replaced, signalling a sturdier, more balanced reserve stack.The reduction in foreign currency assets marks a drop in RBI's holding of US Treasuries. According to data released by the US govt, India's holding of US Treasuries has fallen below $200 billion. Bankers said RBI has been selling down liquid US Treasuries to finance its intervention in the foreign exchange market to support the rupee, which has been under pressure after the announcement of additional tariffs on imports from India.While India has consistently been the fourth-largest holder of foreign exchange reserves after China, Japan and Switzerland, it ranks sixth in holdings of US Treasuries, behind Japan, the UK, China, Belgium and Canada.

1 hour ago

5

1 hour ago

5

English (US) ·

English (US) ·