ARTICLE AD BOX

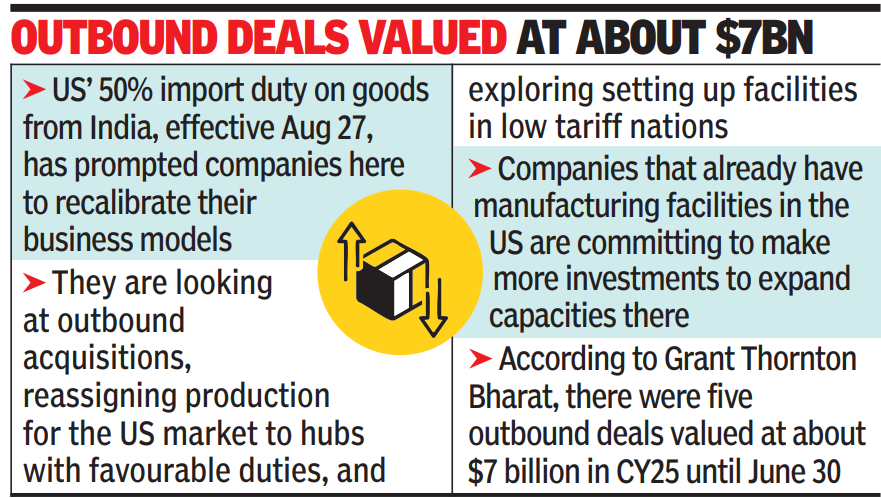

MUMBAI: Indian companies are considering cross-border acquisitions, establishing manufacturing facilities in low-tariff nations like the UAE and Mexico, and ramping up investments in the US to navigate America's new business barriers.While they have been on the prowl for overseas acquisitions, the new US tariffs would accelerate their efforts, particularly for those affected by such duties."The moot question is 'build vs buy'. Setting up a new facility could be time-consuming and subject to various extraneous factors. Acquisition of an existing facility is speedier, but at times, has its own challenges, such as past liabilities, obsolete equipment, and labour issues.

An Indian company will always factor labour costs, which are relatively low in India, while they would be higher in UAE, Latin America or Europe," said Prem Rajani, managing partner at Rajani Associates.

He added: "We suspect any company would set up a manufacturing facility overseas only to cater to the US market unless it makes up the majority of its production and export. The company will also have to ascertain the relationship of that other country with the US."

The country's largest listed garment exporter, Pearl Global, is reshuffling production for US orders by shifting them from India to its other facilities in lower-duty destinations like Bangladesh, Vietnam, Indonesia, and Guatemala. Titan, which owns the Tanishq jewellery brand, is also contemplating moving some of its manufacturing to a Gulf Cooperation Council (GCC) country to maintain low-tariff access to the US, where it is expanding its retail play.

Last month, it announced the purchase of a majority stake in Damas, which has a significant retail presence in GCC. UAE attracts a baseline 10% tax on imports to the US, while India has a 50% tariff effective from Aug 27, making it the most heavily taxed US trading partner in Asia and placing it alongside Brazil, another nation facing steep American tariffs. Complex issues involvedHowever, moving production to GCC or Mexico is more than just an operational shift.

It entails a recalibration of transfer pricing policies, meeting Fema rules on outbound investments, and following local business, labour, and green laws. "Cross-border realignments bring into play complex international tax issues, indirect tax exposure on inter-company flows, and potential scrutiny of profit allocation across various operations. Those who approach this as a holistic and long-term restructuring of operating models and supply value chains, balancing commercial agility with regulatory certainty, will secure durable access to key markets," said Katalyst Advisors partner Binoy Parikh.

Pipe manufacturer Welspun Corp is expanding its Arkansas facility in the US with a $100 million investment, shielding it from America's new trade duties. "US tariffs might be hampering globally, but they are helping us," said Welspun Corp MD Vipul Mathur. Sectors like pharmaceuticals, electronics, energy products, and critical minerals are exempt from import tariffs, aiding players to up their investments in the US. Electronic products manufacturer Aimtron Electronics is looking to acquire a mid-sized company in North America, which will "complement its capabilities and position it closer to its key customers", said founder and chairman Mukesh Vasani. It currently has a manufacturing facility in Palatine, Illinois. Piramal Pharma will invest $90 million to expand its two US facilities -Lexington in Kentucky and Riverview in Michigan-to meet the growing demand.

The US is Piramal Pharma's biggest market, employing about 750 people.

.png)

.png)

.png)

1 day ago

6

1 day ago

6

English (US) ·

English (US) ·